Africa: Botswana Reports

This report was released earlier in May.

The Minister of Finance has announced a wage subsidy for certain businesses registered for tax (irrespective of whether they owe tax) effective April 2020 until June 2020.

Qualifying employers (all conditions must be met):

-

All business sectors are eligible except those listed in section 2 of the guidelines.

-

The employer must be registered with BURS (if not registered, they must register with BURS using the e-service portal). The employer must have a TIN to claim.

-

The employer must make a commitment not to retrench employees as a result of the pandemic.

-

The employers must produce a wage bill from December 2019 until the current period.

Qualifying employees:

-

Only citizen employees employed at qualifying employers.

-

Temporary employees and employees employed at more than one employer qualify – please refer to the guide for more information.

Application procedure:

-

Qualifying employers must complete the Covid-19 Wage Subsidy Claim Form and submit it online using the e-service portal.

-

Any employer who is found to have abused the subsidy shall be liable for prosecution.

-

The successful applicant must submit the claim form each month before the 15th of the month in order to facilitate payment in that month (will be paid by BURS by the 25th of that month). Claims received after the 15th will be paid in the subsequent month.

-

BURS require that the wage subsidy paid to employees be included in the employee’s employment income/remuneration and is subject to PAYE.

This new report is required for the submission of Covid-19 Wage Subsidy Claims. The first submission deadline was the 15th of April but was extended to 20 April 2020. The next submission was the 15th of May 2020 and the following one will be the 15th of June 2020.

You are still permitted to submit the report for April and May even if you have missed the deadline dates – this only means that the wage subsidy will be paid later.

Please Note:

To run the report for April you will have to restore an April backup and update this backup to Release 5.4c. The same will apply for the May submission if you have already rolled over to June 2020.

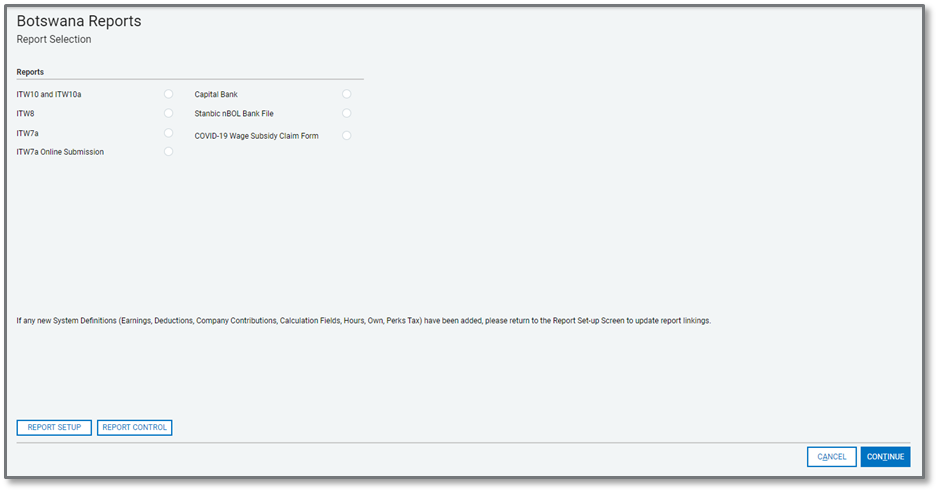

The new Covid-19 Wage Subsidy Claim Report is available on the Botswana Report Screen.

From the Main Menu > Reports > Botswana Reports

The report includes employees based on the following conditions:

-

Only citizen-employees qualify for the wage subsidy. If an employee has no ID Number entered on the Employee Basic Information screen, the employee will be excluded from the report.

-

No validations are done on the validity of the ID Number (Omang).

-

If an employee’s date engaged is 1 April 2020 or any date after 1 April 2020, then the employee will be excluded for all submissions, e.g. April, May, June, etc.

-

If an employee is terminated and the termination date is before the submission date for the selected reporting month, then the employee will be excluded.

Example:

-

The submission date for the applicable month must be entered on the Report Filter screen when running the report. This date will then be used to determine if a terminated employee must be included or not. The Submission Date as selected on the screen is 20 April 2020.

-

If the employee was terminated on the first of April, then the employee will be excluded as this was before the submission date of 20 April 2020.

-

If the employee was terminated on 20 April 2020, on the submission date, then the employee will be included.

-

If the employee was terminated on 25 April 2020, he will be included in the April submission but not in the May submission.

The financial values included in the report are the employee’s contractual Gross Salary for history months, from December 2019 to March 2020, and the current month’s value, e.g. April, May or June 2020. The current month will be determined by your current payroll processing period.

The definition provided by BURS for Gross Salary is not very specific, therefore, you may decide whether you want to report on the employee’s Fixed Gross Salary or Actual Gross Salary.

The report’s default is to use the employee’s Fixed Gross Salary.

Before running the report, you need to do the following:

-

Decide if you want to report on actual gross salary or fixed gross salary

-

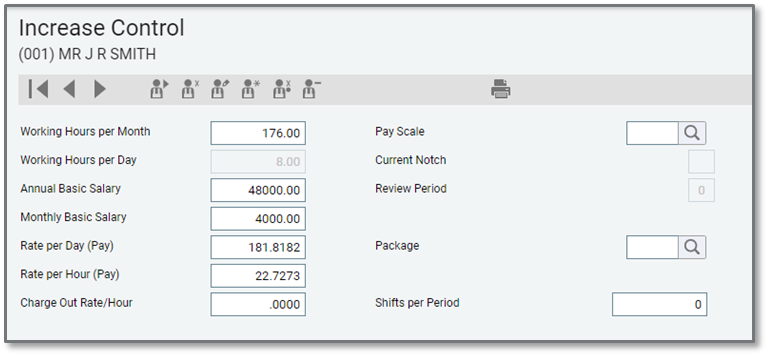

The fixed gross salary option uses the Employee Increase Screen Annual Basic Salary value divided by 12. In Non-Monthly Companies, a monthly equivalent of the employee’s salary as in the last pay period of a month will be used.

-

-

If you have decided to use the actual gross salary, you must complete the Report Setup and the values included in the selection will then be used in the report instead of the Increase Screen values. In Non-Monthly Companies the MTD+ values for the selected lines will be used.

Select the Earnings and/or Calculation Screen option and flag the line items that will form part of the Actual Gross Salary of an employee.

Please Note: When you pay out the wage subsidy on the system, you must add a new earning definition for ‘COVID-19 Subsidy’. This amount is 100% taxable and must be reported as Salaries\Wages or Gross Taxable Remuneration in the standard statutory reports.

Make sure that you do not include the COVID-19 pay out earning definition when linking the Actual Gross Salary under Report Setup for the claim form.

After completing all the report selections, you can continue to run the report.

Indicate if you want to include only the Current Company or Multiple Companies in the export file.

If you select Multiple Companies, you can now select the companies to be included.

Please Note: When you select Multiple Companies, only include companies with the same TIN Number, which are in the same processing month and with the same Earning and Calculation Definition Setups.

Click on the <Continue> button to proceed.

Select who you want to include on the report.

The available options are:

-

All Employees

-

All Employees linked to a specific Analysis Field code, e.g. Department, Pay Point, etc

-

Range of Employees

Click on <Continue> to proceed.

Additional setup information is required and must be completed to create the submission file with the correct required values.

The following fields must be completed:

|

Field |

Description |

|---|---|

|

Fixed Gross Salary |

Tick this option if you want to use the employee’s fixed salary as captured on the Employee Increase Screen. |

|

Actual Gross Salary |

Tick this option if you want to use the employee’s actual salary as selected on the Report Selection Screen. |

|

Company Account Number |

This is an optional field and can be completed at the user’s own discretion. This is the company’s bank account number that will be used when paying out the subsidy claim – the employer must then pay the employees. |

|

Submission Date |

You must select the relevant month’s submission date as this is used to determine which terminated employees will be included in the report. For April, this date is the 20th and for May and June it is the 15th. If you do not select a submission date, then all current month terminations will be included |

|

Location for Submission File |

Here you can select where the submission file generated from the system must be saved. |

Once all the fields are completed, you can <Continue> to create the submission file.

The BOTcovid.csv file will be saved in the location selected on the report input screen. No additional report will print.

The CSV file is unprotected. The reason for this is that BURS did not provide clear details on who must be included nor on values that are mandatory or required. For this reason, we decided to keep the file unprotected so that you can make changes to the submission file should you disagree with the employees or values included in the file.

Please Note: If you decide to open or amend the CSV file, please do not open the file using Excel, as this may change the formatting of the values included in the report, e.g. drop the leading zeroes of the employee ID Number or the decimal cents of financial values. If you do use Excel to open the CSV file, then you will have to manually amend formatting changes. We advise that you rather open the file in Notepad.

The Botswana Unified Revenue Service (BURS) issued a notice stating that the new Lekgetho Live Tax Management System will go live on the 11th of May 2020.

This new system requires the following changes to the existing ITW7A Online Submission File:

-

A new field for Furniture Benefit was added to the report. This field must include the furniture perks that employees receive and must, therefore, now be excluded from the Other Benefits field.

-

The field name for ‘SeverancePay’ was changed to ‘SeverancePayGratuity’.

-

A new field was added for ‘ExemptionAmount’. This field must include the exempt portion of Severance, Retrenchment Packages and Gratuities paid to employees.

-

The value included in the field for ‘Payments to Approved Fund’ must include the full value of approved superannuation fund contributions and not only the tax-deductible portion. This is not an actual change on the report but will require a relinking of the values on the report selection screen.

For the new Furniture Benefit and Exemption Amount fields, we added new report field selections to the Report Selection screen.

Before running the report, you must update your Report Setup to link all applicable definition lines to the new Furniture Benefit and Exemption Amount selections.

Please Note: You must unlink the furniture perk lines from the ‘Other Benefit’ selection to ensure that the employee’s benefits are not over-stated in the report.